Benecaid’s Health Spending Account (HSA) is a great alternative (or supplement) to a traditional employee health benefits plan. It’s an account that is established to exclusively pay for health care services for you and your family members. It doesn’t include any traditional insurance coverage and can be used to pay for expenses that aren’t covered under traditional plans such as laser eye surgery or fertility treatments. Optional insurance protection is available.

Health Spending Account (HSA)

Members can choose from a wide range of eligible expenses

Optional insurance coverage to protect against unforeseen expenses

Eligible contributions are a tax deduction for your company and a non-taxable benefit for employees

Eligible dependents can include additional family members outside of your spouse and children

Decide how much to deposit

You can use our online HSA Calculator to help you decide how much to deposit.

Contributions to an HSA are subject to CRA reasonability tests. Benecaid recommends

consulting with a professional tax advisor. Deposits into your HSA may be used

as a corporate tax deduction and can reduce the taxes you pay.

Add additional insurance protection

Add hsaComplete and Travel coverage to protect you and your family from unexpected costs.

These optional products provide annual protection for

a low monthly premium, which can be paid using your HSA dollars.

Choose from a wide range of eligible expenses

Claims can be easily submitted online through your smartphone or tablet.

There is a large list of eligible expenses that can be covered through a Health Spending Accounts (HSA).

Please visit the CRA website for more information: www.cra-arc.gc.ca/medical.

HSA CALCULATOR

how much you could save them by opening an HSA!

Enter your employee income

Enter the annual amount of money currently spent on out-of-pocket medical expenses

UNSURE OF YOUR EXPENSES?

We can help!

What province do you live in?

TOTAL SAVINGS WITH AN HSA*

CLICK HERE TO SEE HOW WE CALCULATED YOUR SAVINGS

MEDICAL TAX CREDIT

HEALTH SPENDING ACCOUNT

NOTES:

(A) The Medical Tax Credit Threshold is the lessor of 3% of your taxable income or $2,302 for 2018.

(B) The amount eligible to go towards the MTC is the $ amount over and above the threshold. (Health Care Costs less the MTC Threshold).

(C) The eligible amount multiplied by the lowest tax bracket in the province that you reside.

(D) This amount is the Health Care costs less the MTC figured out in Step C.

(E) This amount is the additional money that you would have to earn to be able to pay for the final health care costs figured out in Step D.

*Applicable taxes are calculated based on your province and may include GST/HST, Premium Tax and or PST. Premium tax and PST are charged on the gross income and the administration fee. GST/HST is charged only on the administration fee.

**The Annual Account Fee is $95 per employee’s Health Spending Account.

WHAT ARE THE ROUTINE MEDICAL EXPENSES FOR YOU AND/OR YOUR FAMILY?

DO YOU HAVE ANY FUTURE MEDICAL PROCEDURES PLANNED?

DO YOU HAVE ANY SPECIALTY EXPENSES?

1-877-797-7448

*For terms and conditions please click here

“I used my Benecaid HSA to cover the extra cost of my prescription glasses.

I was really glad I had added that extra coverage.”

Dave H.

| HSA* | TRADITIONAL | |

|---|---|---|

| Acupuncture | ||

| Assistive Mobility Device | ||

| Audiologist Services & Hearing Aids | ||

| Autism Treatments | ||

| Cataract Surgery | ||

| Chiropodist Services | ||

| Chiropractic Services | ||

| Contact Lenses | ||

| Dental Hygienist Services | ||

| Dental Surgeons Services | ||

| Dental Technologist Services | ||

| Denturist Services | ||

| Dermatology Services | ||

| Drugs | ||

| Elderly Parent & Dependent Care | ||

| Fertility Drugs & Treatment Services |

| HSA* | TRADITIONAL | |

|---|---|---|

| Laser Eye Surgery | ||

| Massage Therapists (RMT) | ||

| Medical Laboratory Services | ||

| Medical Radiation Treatments | ||

| Midwife Services | ||

| Naturopath Services | ||

| Occupational Therapist Services | ||

| Optician Services | ||

| Optometrist Services | ||

| Orthodontic Services | ||

| Physiotherapist Services | ||

| Prescription Glasses | ||

| Prescription Sunglasses | ||

| Private Nursing Services | ||

| Psychologist Services | ||

| Respiratory Therapists |

*The list above is an example of some of the expenses that can be reimbursed through a Benecaid HSA. This list is in accordance with the rules governing the Medical Tax Credit and is subject to change. Please note that this list differs based on province or territory. Please visit the CRA website for more information.

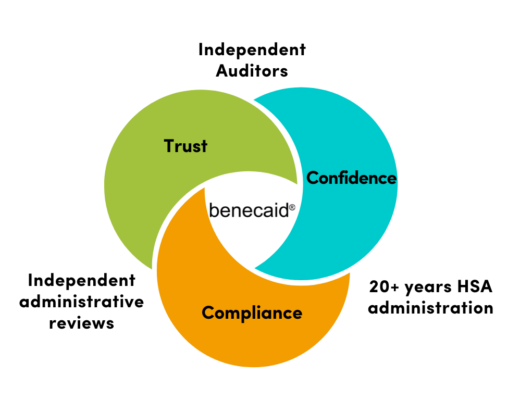

for your Health Spending Account provider.

Benecaid offers a comprehensive travel plan through Green Shield Canada’s (GSC) travel provider, Global Excel Management (GEM).

hsaComplete

Provides insurance coverage for unexpected and catastrophic medical expenses for individuals with an HSA.

Coverage Includes:

- $25,000 pp in drug coverage ($100,000/family)

- $5,000 pp in semi-private hospital coverage

- $10,000 pp in private duty nursing

- $5,000 pp in accidental dental coverage

- $5,000/person in ambulance coverage ($20,000/family)

- You can use your HSA to pay for the premiums

and someone will reach out to you