Guest post written by Chubb Workplace Benefits

Life throws plenty of curveballs, like getting hurt or sick. It’s inevitable. A case of the sniffles or a pulled muscle usually means a short recovery period and no missed days at work. But contracting a serious illness or experiencing a major injury may result in several weeks or months of recuperation which could lead to financial problems for unprepared families.

Luckily, there are practical solutions that companies can take advantage of at little to no cost with big benefits to employees: Disability Insurance and Accident Insurance from Chubb Workplace Benefits.

If an employee uses all their sick days and their illness continues beyond the 15-week period of Canadian Employment Insurance, they are on their own in trying to maintain financial stability without a regular paycheque. Mortgages and car payments just don’t go away when a person falls ill, so it makes sense for employees to avoid that kind of financial strain once their Government benefits end. Employees want options, which is why benefits advisors and employers should offer Chubb Workplace Benefits which are customizable, flexible, and affordable.

Our valuable insurance products supplement where employer and Government benefits stop.

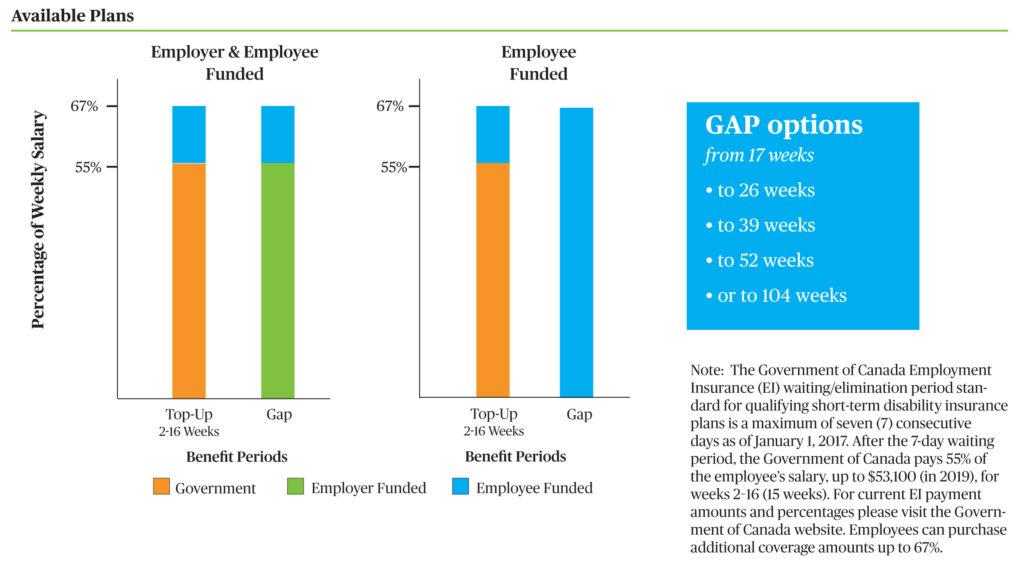

Disability Insurance provides a fixed benefit that offers weekly income replacement above and beyond Employment Insurance for an employee suffering a covered illness or injury. Employees can « Top-Up » the 55% of the employee’s salary (at a ceiling of $53,100) from Government-provided coverage, adding benefits up to 67% of the employee’s income, up to $1,250 per week. A « Gap » option is also available once the Government-provided benefits end, extendable up to the 104th week from disability.

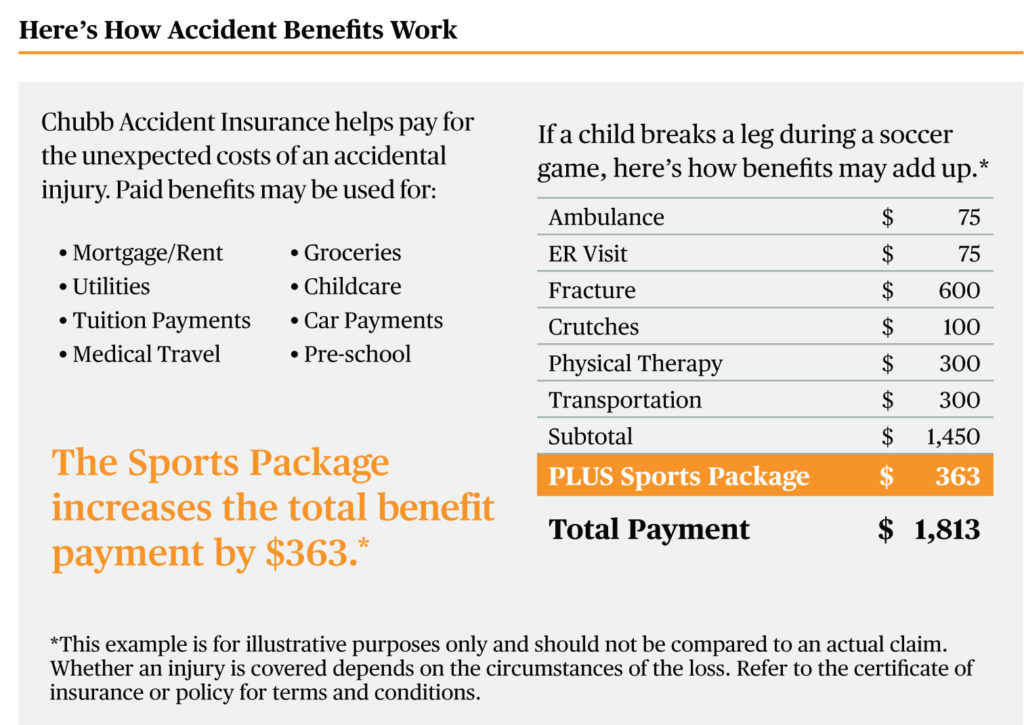

Another valuable Chubb Workplace Benefits product is Accident Insurance. It provides benefits that can be used to cover unexpected expenses from accidents requiring treatment. Benefits are based on initial care, treatment, facility care, and follow-up care for covered injuries, and payable directly to employees. Benefits advisors can offer employers a range of benefit amounts from three plans: Gold, Platinum, and Diamond. What’s even better is that employees have the option to upgrade their plans to include coverage for their families.

An innovative feature of our Accident Insurance is the Sports Package, for those employees and their families who participate in organized sports. More than 17,000 Canadians suffer sports-related injuries in 2016-17, according to data from the Canadian Institute for Health Information. If an employee is active in sports and is concerned about getting injured and incurring additional expenses, the innovative Sports Package is ideal for them. The Sports Package pays out a 25% higher benefit for an organized sports-related injury, up to $1,000 annually. This can be used towards unforeseen travel and medical expenses.

Also, Chubb Workplace Benefits’ Accident Insurance offers different types of Rehabilitation Benefits, which can provide financial support for up to 30 days of recovery in a rehabilitation facility, or a daily Recovery Benefit for up to seven (7) days for recuperating at home.

Childcare outside of the home is a necessity for many Canadians. Nearly half of Canada’s parents say they use some type of childcare for kids ages 14 and under [Statistics Canada]. With Accident Insurance from Chubb Workplace Benefits, if employees were to suffer an accident and need childcare while tending to their medical needs, or while recovering in a hospital or rehab center, the Family Care Benefit pays daily benefits for each child in organized childcare from five to 30 days.

Chubb’s Accident Insurance and Disability Insurance products are helping benefits advisors and employers build better benefit plans which employees truly want and need. This added value will help to attract and retain employees, providing extra peace of mind.

Still Have Questions?

If you have questions about Chubb Workplace Benefits products, or if you’re an advisor interested in offering these benefits to your clients, we encourage you to get in touch with a Benecaid Benefits Consultant at advisors@benecaid.com. You can also reach out directly to Chubb Workplace Benefits by contacting Tanya Eyram, Vice President, Group / Worksite Division at tanya.eyram@chubb.com.

Comments are closed.